The Spring Checklist for Your Spring Cleaning

Congratulations…we did it, guys! We made it to Spring. After all those cold, dark, and short winter days, we can finally, and even desperately, open our windows and let in the fresh air of the Spring. However, before we do, it’s important to make sure your home is ready to take on the Spring and…

Avoiding Those Nasty Potholes

Why is a “pothole” called a “pothole?” Well, turns out the term was originally used (as cited in 1826) to describe deep, cylindrical-shaped holes in glaciers and gravel beds. So, as a result, it made sense calling the holes that form in the road, which has a similar shape, a “pothole.” February, March, and April…

Is Your Business PCI Compliant?

If you own a business that accepts credit cards, listen up. The Payment Card Industry Data Security Standard (PCI DSS) applies to you. Think about this, every time a customer swipes his/her card, they’re entrusting you with their personal information. They have absolute confidence that their information is safe and free of a hacker getting…

Customer Spotlight: Nina’s Cookies

The sensation that you get when sinking your teeth into a sweet from Nina’s Cookies will make you understand the care and love that is baked into everything they make. The foundation of Nina’s Cookies was built on love. Antonina Ciarcia (Nina) married Angelo Mazza in her hometown of Canicattina Bagni, Italy in 1949. Later…

Winter Driving Safety Tips

If you’ve lived in New England, you know how easy it is to become accustomed to winter weather and not think about the risk of winter driving. Therefore, if you’re planning on hitting the roads this winter (most likely all of you will say yes) here are some winter driving tips to keep you safe.…

Field Guide for Avoiding Ice Dams this Winter

Every winter, ice dams take their toll on houses all across America. They ruin roofs, walls, and can create a massive mess for homeowners. Understanding the components of ice dams will help you take the right steps for preventing them from happening. How do Ice Dams Form? Ice dams form when snow or ice melts…

What Is an Umbrella Policy and Why Do You Need One?

Take a second and imagine that you’re 61-years old. Imagine that you’re well-seasoned in your career, just a few years away from retirement, and have a healthy portfolio of assets. You have two homes – one permanent and one vacation – and a car that is all fully paid off. Suddenly, as you’re driving up…

Why You Should Know What “Coverage Gaps” Are

Surprises are a part of life. Month in and month out, we confront new obstacles, and no matter the size, these obstacles can be surprising and sometimes undesirable. In the insurance world, these “undesirable surprises” are called “gaps” and they’re never enjoyable. However, if you know these policy gaps it can lessen the impact of their…

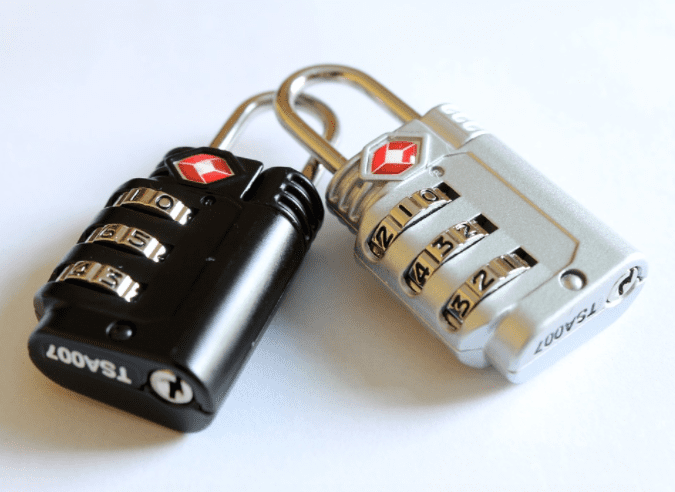

2017 Resolutions: Safer Credit Card Practices

Cue the whistles and bells. It’s the New Year! Have you made your resolutions yet? If so (or not) It’s important to know that worldwide fraud losses on credit, debit and prepaid cards in 2014 topped $16 billion, according to the Nilson Report, a trade publication for the global credit-card and mobile-payment industry. Thus, we…